Table Of Content

When booking, you will be guided through the process of getting declaring any medical conditions you may have. Rest assured, your information will be treated with the utmost trust and confidentiality. While these coverage types are common among cruise insurance policies, checking the terms and conditions to confirm all coverage areas is a good idea. The Explorer Plan is World Nomads' premium travel insurance plan and covers a longer list of activities than the Standard Plan. You can review the list of covered activities here and decide if the more affordable Standard Plan works for you. Seven Corners offers a standard Trip Protection Economy plan and a more premium Trip Protection Elite plan.

Travel Insurance Reviews

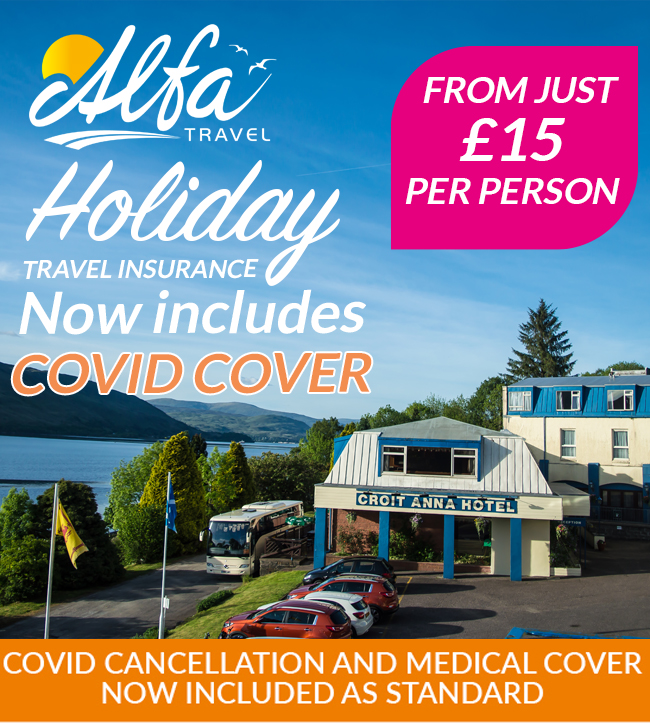

CFAR allows you to recoup 50% or 75% of your forfeited, nonrefundable trip costs, depending on your policy. Seven Corners’ Trip Protection Choice plan has great upgrade options and benefits across the board to cruise goers, including unrivaled medical coverage limits and very good missed connection benefits. We only scored plans that cover COVID-related cancellation and medical expenses, and plans that offer missed connection coverage. USI’s Ruby plan offers well-balanced coverage that meets our standards for emergency medical and evacuation coverage. Holiday Extras has over 30 years’ experience selling travel insurance.

Lost or delayed baggage

Before you purchase cruise insurance from a cruise line, compare your third-party options. You can get quotes from multiple travel insurance companies at once using a travel insurance aggregator such as Squaremouth. Because cruises are often less flexible than other types of travel, it’s generally a good idea to get cruise travel insurance.

Best Cruise Travel Insurance for Young Travelers: Aegis

It also has very good trip interruption and hurricane and weather coverage at a competitive price. Nationwide’s Cruise Luxury plan provides an array of extensive benefits at a decent price, including superior missed connection coverage and emergency and non-medical evacuation benefits. Our insurance experts reviewed 40 aspects of 37 travel insurance plans to find the best cruise insurance. WorldTrips offers the best cruise travel insurance, according to our analysis. If you’re shopping for travel insurance for a cruise, use this guide to compare the cost and coverage of top-scoring plans. Most cruise insurance includes coverage for missing a departure port, so you should be able to claim for a missed port.

If there is any conflict between what an insurance provider tells you and what your contract says, the contract is what you should rely on. I was fortunate enough to sail on P&O Cruises ship, Britannia , a few years ago, sailing through the Norwegian Fjords and visiting several towns along the way, including Bergen, Flam and Stavanger. It was a truly unforgettable experience I would recommend to anyone of any age. I saw and experienced so much (including kayaking in a stunning bay and taking a speedboat tour to the set of the TV show Vikings!), there’s just nothing else like it. On board I ate like a king, made new friends and was never at a loose end. This blog helps over a million people to plan their cruises each month.

Buying right after you book also lets you lock in trip cancellation coverage right away. U.S. health plans may have very limited or no coverage when you’re outside the U.S. And Medicare doesn’t cover medical care outside the U.S., with only very narrow exceptions. You can buy cruise insurance from your cruise line, through a travel agent or from a travel insurance agent or company. The average cost of cruise insurance is 5% to 6% of the value of your cruise vacation, which should include the cost of all prepaid, nonrefundable expenses such as flights and excursions.

It's usually best to purchase cruise insurance shortly after booking. This lets you take advantage of the protections sooner and qualify for certain benefits such as pre-existing condition waivers. A pre-existing conditions waiver applies when you purchase coverage within 15 days of the initial trip deposit. This plan includes $35,000 in rental car damage coverage (where it's valid) due to collision, theft or a natural disaster.

The FCDO’s advice can change at any time, so make sure you check it’s safe to travel before you set off. It’s important to understand how viruses, food poisoning and other health outbreaks could affect your cruise. Check your policy documents for more information and take a look at our COVID Travel Insurance to learn more. It's advisable that you take your Ehic or Ghic with you if your itinerary includes stops in any EU countries, as it could allow you to access state healthcare. For example, if you signed up to an eight-stop cruise but due to a faulty engine you could only stop at six. If a significant proportion of the services on your cruise can't be provided, you should be entitled to compensation from the cruise operator too.

No plan will meet the needs of all cruise travelers, so there is little benefit to booking the one insurance option recommended by your cruise line during the booking process other than convenience. The Travel Basic plan from Travelex Insurance Services cost $116 for our sample trip; just below the average for plans listed here. After our analysis, we've determined these are some of the best cruise insurance options available. The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone.

If you find yourself stranded at the pier long after your cruise has left, or aren't able to get to the pier at all, cruise travel insurance can help. Cruise insurance may cover missed connections, but it's important to read your policy before you purchase it. Each policy has different limits on how much you'll be reimbursed and what exactly you'll be reimbursed for.

Insurance usually increases the price of a cruise by anywhere from three to ten percent depending on various factors. If a ship isn’t near the United States at the time of an emergency, a sick traveler may need to seek medical treatment in a foreign country. Most American health insurers and Medicare will not cover foreign medical treatment under standard coverage. Cruise insurance eliminates or greatly reduces out-of-pocket expenses. At Holiday Extras we cover thousands of pre-existing medical conditions with our travel insurance packages and your Cruise insurance is no exception.

Nationwide Travel Insurance Review and Pricing 2024 - MarketWatch

Nationwide Travel Insurance Review and Pricing 2024.

Posted: Thu, 11 Apr 2024 07:00:00 GMT [source]

And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence. A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best cruise insurance plan that won't leave you high and dry in an emergency.

Travel insurance typically covers cruises and other types of travel, whereas cruise insurance is designed to specifically protect you while cruising or getting to your cruise. Trip cancellations are covered for 100% of the trip cost (up to a max of $150,000) and trip interruptions are covered for 150% of the trip cost (up to a max of $225,000). The full trip cost (100%) is covered for both cancellations and interruptions. A cruise is an ideal vacation for anyone who likes the all-inclusive concept, where you pay one price and have just about everything taken care of, from accommodations to meals and activities.

The information is accurate as of the publish date, but always check the provider’s website for the most current information. A typical cruise refund policy might entitle you to a full refund if you cancel far enough in advance — which might mean 90 days or more before your departure date. If you want to cancel within 14 days of departure, you might not be able to get any refund at all.

For example, you might be able to rebook a flight or hotel room, but if you cancel your cruise, you could lose your deposit or more. Often, cruise lines won’t offer any refunds if you cancel within a certain period before your cruise, such as 14 or 30 days. Taking a cruise is one of the easiest ways to travel, but cruising isn’t immune to unexpected hiccups. Sudden illness, travel delays, or other unforeseen events could cancel or interrupt your cruising plans — you might even need medical coverage. Preexisting medical conditions are covered by this policy, though you must purchase your policy within 14 days of your trip deposit.

Tailored options are also available from Holiday Extras should you have pre-existing medical conditions. Securing the best cruise insurance isn't just about finding the best price; it's about ensuring it covers all your potential needs. Medical coverage ensures that if you fall ill or get injured, your medical expenses won't sink your finances. If you’re not sure, get a quote for a single trip and an annual multi-trip policy and compare the prices.

No comments:

Post a Comment